- Homepage

- Economy and Finance

- Industry

Industry

Barometer Manufacturing industry

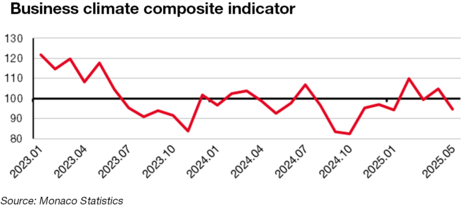

According to the business leaders surveyed, the business climate deteriorates and falls below its average in May in the Manufacturing industry.

Standardised synthetic indicator with mean 100 and standard deviation 10

Download the methodology of the manufacturing industry business survey

Observatory

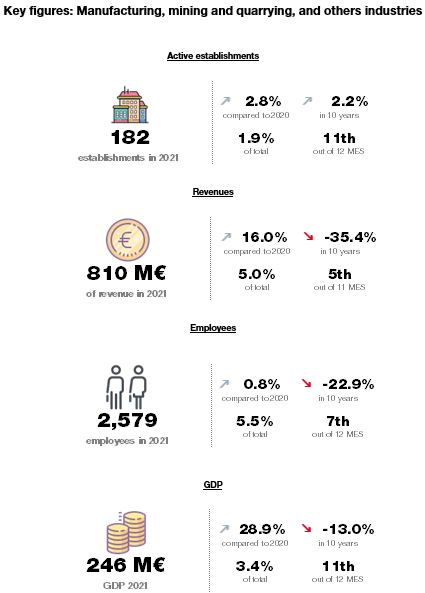

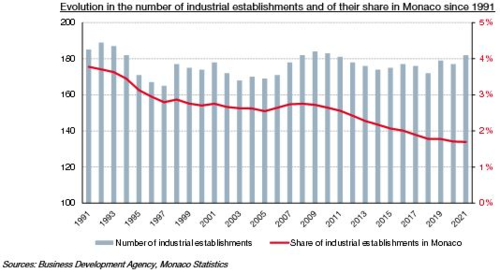

Over the last 30 years, the number of industrial establishments has been relatively stable. It varies between 165 and 189 entities. In 2021, the industry has 182 active establishments, 5 more than the previous year (+2.8%). This is the highest number of entities since 2010 (183).

However, the share of Industry continues to decrease from year to year. In fact, this sector of activity represents 1.7% of the Principality's active entities in 2021, compared to 3.8% in 1991, despite a similar number of establishments (185).

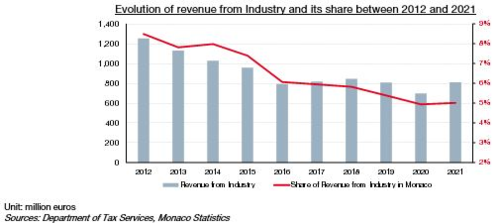

In ten years, the Industry's revenue has fallen by more than a third (-35.4%) compared to its 2012 level, i.e. a loss of 444.3 million euros.

The last decade has been marked by contrasting results. Industry peaked at €1.25 billion in 2012, before gradually declining. In 2015, Industry recorded a turnover of 958.0 million euros, marking the end of ten consecutive years above the billion euro mark. Since 2016, industrial activity has stabilised, fluctuating between €793.8 and €846.0 million (except for the year 2020, which recorded €698.2 million following the COVID-19 pandemic).

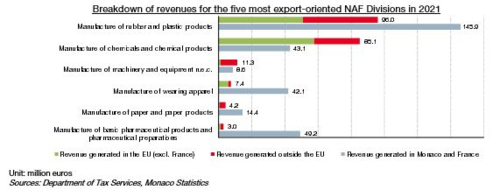

Export turnover from the Manufacture of rubber and plastic products is evenly divided between sales to EU countries excluding France (€50.8m) and those outside the EU (€45.2m). The Manufacture of chemicals and chemical products makes the majority of its exports through in the EU (67.7%), as does the Manufacture of wearing apparel (78.8%). On the other hand, trade in products from the Manufacture of machinery and equipment n.e.c. is mainly with non-EU countries (89.6%), as is the case for the Manufacture of paper and paper products (86.6%).

Certain Monegasque industries are very dependent on their sales outside the monegasque and french territory. Among the various branches of the sector, two generate more turnover outside its borders than in Monaco and France. This is the case for the Manufacture of chemicals and chemical products (66.4%) and the Manufacture of machinery and equipment n.e.c. (56.7%).

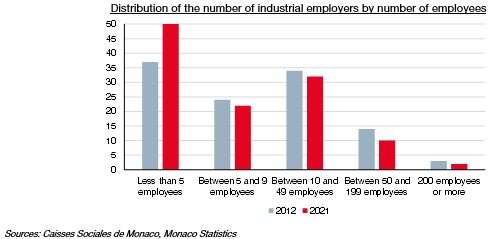

Although the number of industrial employers is broadly similar after ten years, the difference is in their size. Large companies are gradually giving way to smaller companies with fewer employees.

In 2021, 50 structures employ less than 5 employees, compared to 37 in 2012. They are mainly present in Manufacturing (45). A quarter of these employers are engaged in the Repair and installation of machinery and equipment (12).

Overall, small companies with less than 10 employees are increasing, rising from 61 to 72 entities in ten years. Those employing between 10 and 49 workers remain stable (32 against 34). Conversely, the number of employers with at least 50 employees have fallen by almost 30% (-5) over the period observed.

Between 2012 and 2021, this trend is illustrated in key branches of Monegasque manufacturing. The Manufacture of rubber and plastic products had 4 employers with 50 or more employees, compared to 2 in 2021, to the benefit of companies with less than 10 employees, which rose from 4 to 7. Similarly, 5 Manufacture of basic pharmaceutical products and pharmaceutical preparations have fewer than 10 employees, 3 more than ten years ago. An identical variation in the Manufacture of computer, electronic and optical products, which in addition to this sees the disappearance of 2 large structures, each employing between 50 and 199 employees.

These changes have a direct impact on industrial employment given the size of the sector.

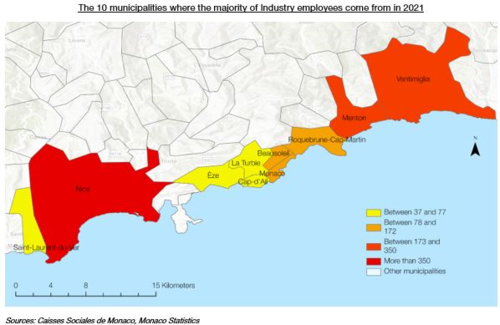

In 2021, 2,060 employees live in the Alpes-Maritimes (79.9%), of which 437 are in neighbouring municipalities (17.0%). Roquebrune-Cap-Martin has 165 and Beausoleil 160. One worker in four comes from Nice (665) and 13.8% from Menton (350).

In addition, 324 workers come from Italy (12.6%). Moreover, Ventimiglia is the third most represented municipality among the sector's employees (210), ahead of Monaco.

Industry employs 172 residents of the Principality, the lowest number after Information and Communication activities (118). In volume, only 6.7% of employees in Industry live in Monaco, making it the MES with the lowest proportion of resident employees after Construction (4.5%).

Of the 432 employees in the Manufacture of chemicals and chemical products in 2021, 311 come from the Alpes-Maritimes outside the neighbouring municipalities (including 123 from Nice). Similarly, this manufacturing branch also has the most residents in the Principality (31). Residents of neighbouring municipalities work mainly in Waste collection. Almost one Italian resident in three is employed in the Manufacture of wearing apparel.

- 12 August 2025 Barometer Retail trade : June 2025

- 12 August 2025 Barometer – Manufacturing industry : June 2025

- 12 September 2025 Barometer Retail trade : July 2025

- 12 September 2025 Barometer – Manufacturing industry : July 2025

- 17 September 2025 Quaterly Economic Report Q2 2025